Thursday, January 13, 2011

Blog Assignment Number 2

Wednesday, January 12, 2011

Blog Post 2

1. Who do you believe would be interested in this statistic?

a. Everyone needs to be interested in this statistic. Whatever the consumers expect from the market and are willing to put into it at any given time is something that affects the entire market. Producers are interested in how much they can expect to make, suppliers are interested in when to increase or decrease production, and stockholders are interested in when a stock is about to rise or decline. Personal consumption accounts for 2/3 of our total GDP, so the confidence of the consumers has an enormous impact on the economy

2. How is this statistic collected? (Who? How frequently?)

a. The Washington Post-ABC News Consumer Comfort Index is a rolling average based on telephone interviews with 1,000 randomly selected adults. It covers the previous four-week period. Interviewees are asked about the state of the nation’s economy, the state of their personal finances, and whether they are buying things at the current time.

b. The Conference Board Consumer Confidence Index: This survey is based on a representative sample of 5,000 U.S. households. Interviewees are asked about their short-term outlook, their current financial conditions, and their perceptions of the job market.

c. The Thomson Reuters/University of Michigan Consumer Sentiment Index: At least 500 telephone interviews are conducted each month in the United States. Interviewees are asked 50 core questions such as how they felt financially six months ago, how they feel about their current conditions, and what they expect six months in the future.

3. Include the most recent number for the statistic and enough information to put it into context.

a. The Thomson Reuters/University of Michigan preliminary index of consumer sentiment improved to 74.5 at the end of December 2010, its best level in six months. This number was up from 71.6 in November and 67.7 in October. While it may have benefited from holiday sales, overall consumers were expecting favorable news for the upcoming year. While their views on their financial situations remained negative, job gains are on the horizon and the economy can expect an increase in consumer spending as a result of an increased consumer confidence index.

4. References/Links

a. http://www.bloomberg.com/news/2010-07-16/consumer-confidence-declines-more-than-forecast-to-66-5-in-michigan-index.html

b. http://wallstcheatsheet.com/breaking-news/economy/your-cheat-sheet-to-consumer-confidence.html

Blog Assignment 2

Auto Sales

Blog #2

Blog #2

The Herfindahl Index (HHI) is a measure of the size of firms in relation to their industry. It also indicates the amount of competition between the firms inside their industry.

The index ranges from 0 to 10,000. The lower the rating, the more highly competitive firms are in the market and vice-versa, therefore a score of 10,000 would indicate a monopoly. (bizterms) An industry with a score over 2,000 is considered to have very low competition with very few firms controlling most of the market share, while one below 1,000 is considered to be highly competitive with many small firms.

1. This statistic would be useful for new firms or firms looking to enter a new market because it would give them an accurate measure of the competition in the market. It would also be useful for firms looking to view the level of competition of the industry they are in. (Chin, Andrew)

3. The HHI for the breakfast cereal manufacturing is 2,521.3, meaning very few firms control most of the market share. (US Economic Census)

References

- Bizterms.net. Retrieved 1/11/11 http://www.bizterms.net/term/Herfindahl-index.html

- Chin, Andrew. UNC School of Law. Revised December 2010. Retrieved 1/11/11 http://www.unclaw.com/chin/teaching/antitrust/herfindahl.htm

- US Economic Census Bureau. Concentration ratios for 2002. Manufacturing. Subject series. US Department of Commerce. Economics and Statistics Administration. Economic Census 2002. Retrieved 1/12/11. http://www.census.gov/prod/ec02/ec0231sr1.pdf

Blog Assignment #2: Total Business Inventories

Assignment #2 Consumer Confidence

Blog Assignment #2 - National Debt

2. The U.S. Treasury is responsible for collecting and reporting this statistic continuously because it fluctuates both positively and negatively throughout any given day. The national debt is simply the sum of any outstanding obligations of the government at any given time and is thus fairly simple to calculate given the information that the U.S. Treasury has access to. There are many national debt clocks scattered throughout the country and some that appear online that continuously report the status of the national debt in several forms including per capita debt. The Office of Management and Budget in the White House is responsible for submitting budget proposals to congress and making budget projections for the future.

3. The current national debt is over $14 trillion ($14, 030, 789, 856, 634) now according to the U.S. Treasury. This is significantly higher than ever before in the past and has many citizens and government officials concerned. Over the past five years the debt has increased almost $5 trillion dollars but this statistic must be put into context with the business cycle. As the US is still in a recession government spending has dramatically increased over the past few years and is still increasing today. This is a logical attempt of our government to offset the drop in GDP caused by the recession and to stimulate the economy. The main reason for our inflated national debt is irresponsible fiscal policy during times of economic growth (i.e. Bush tax cuts earlier this decade). Although the debt appears to be getting out of hand, we must understand that this is due to our government currently making fairly strong fiscal decisions and that once out of this recession the debt will be dealt with with greater enthusiasm.

References:

U.S. National Debt Clock: Real Time

http://www.usdebtclock.org/

Knoller, Mark. "National Debt Tops $14 trillion". CBS News: Politics.

Office of Management and Budget. www.whitehouse.gov.

Tuesday, January 11, 2011

Blog Assignment #2

Blog Assignment #2

1.) There are many people and organizations that would be interested in this statistic. However, consumers who drive cars would be the most interested in the changes in gasoline prices, as they have to purchase gas in order to drive their vehicles.

2.) According to this websites, the U.S. Energy Information Association collects these prices and statistics on a weekly basis.

3.) The average U.S. gas prices is $3.089 per gallon. This prices has risen $0.019 from last week, and $0.338. Gas prices have been rising slowly over the past year. As a related statistic, diesel prices have risen $0.002 per gallon from last week (currently $3.333) and $0.454 from last year.

source:

U.S. Energy Information Association. EIA, - 2011. Web. 10 Jan. 2011.

1) I believe that anyone who was interested in buying a new home would be very interested in this statistic. This would help their decision whether or not they should invest in a new house at this time.

2) These statistics are estimated from sample surveys. They are taken once a month. They are collected by the U.S. Census Bureau and the Department of Housing and Urban Development.

3) Sales of new single-family houses in November 2010 were at a seasonally adjusted annual rate of 290,000. This is 5.5 above the revised October rate of 275,000, but is 21.2 percent below the November 2009 estimate of 368,000. This means that it may not be the best time to be buying a new house.

www.census.gov/const/newressales.pdf

Blog Assignment #2

Blog Assignment #2 Labor Productivity

2. The Bureau of Labor Statistics collects the labor productivity statistic every quarter by comparing the amount of goods and services produced with the inputs used for production.

3. The Third Quarter 2010 Percent Change in Productivity from Q2 to Q3.

Nonfarm Business 2.3

Business 2.5

Manufacturing 0.6

Durable Manufacturing -0.5

Nondurable Manufacturing 3.2

Bureau of Labor Statistics. "Productivity and Costs, Third Quarter 2010, Revised." Last modified December 1, 2010. http://www.bls.gov/news.release/prod2.nr0.htm

Blog #2

On the Graph below (which I know is pretty hard to see =/ sorry) The dotted line represents the United States average HOVR over the years, and the other colored solid lines are where particular states have been at based on the U.S. average.

Sources:

1. United States Census http://www.census.gov/hhes/www/housing/hvs/hvs.html

2. The Federal Reserve Band of Minneapolis http://www.minneapolisfed.org/publications_papers/pub_display.cfm?id=2269

Blog Assignment #2

Annual U.S. Motor Vehicle Production

1. I think that mostly the automakers are interested in this statistic because they have to know how big the demand will be in the next year/quarter/month. But also suppliers might be interested as well as the government, because it has to care for a well equipped infrastructure (highways, parking spots, intelligent traffic systems).

2. OICA, the “International Organization of Motor Vehicle Manufacturers” publishes that statistic every year. But probably there are several other statistics about monthly production and different other variations. I assume that the number are the added numbers of all the vehicle assembly plants within the U.S. .

3. Due to the freshly started year 2011 the numbers for 2010 are not published yet. That is why I only can write down the number for 2009: in 2009 there were 5,708,852 vehicles produced in the US. But, what I do can say is that the estimate number for 2010 is about 7,800,000 vehicles, that is an increase of 36,6 % and therefore pretty considerable. You also can figure out with these datas that the U.S. in 2009 has been the third biggest vehicle producer throughout the world. First one is China with 13,790,994 vehicles, followed by Japan with 7,934,516 vehicles.

International Organization of Motor Vehicle Manufacturers, 2009 production statistics, 2009, http://www.thetruthaboutcars.com/2010/12/car-production-2010-u-s-a-beats-china-in-percentages/

Unemployment Rate

Blog Assignment #2

Blog Assignment #2

2. This statistic is collected by the US Census Bureau. Every Month.

3. In October, the nations international trade deficit in goods and services decreased from $44.6 billion in September to $38.7 billion. A trade deficit means that a country is importing more goods and services than they are exporting. This decrease in deficit is a good sign, considering in June the deficit increased by 18.8% to $49.9 billion.

Sources:

The Trade Deficit Nightmare. August 14,2010. http://theeconomiccollapseblog.com/archives/the-trade-deficit-nightmare

U.S. International Trade Data. December 10,2010. http://www.census.gov/indicator/www/ustrade.html

The Trade Deficit and Exchange Rates. http://economics.about.com/cs/analysis/a/trade_deficit.htm

Blog Assignment #2: Assigned Statistic

Source : Monk, John. "2010 Traffic Deaths Lowest in Decades." The State: South Carolina (2011). Web.

1. Citizens of South Carolina would be interested in these statistics, and possibly comparing these stats to other states.

2. These "unofficial" stats are collected by the South Carolina Department of Public Safety Office of Highway Safety, collected every year.

3. In 2010, the total state traffic fatalities came to about 770, which is a 14% drop in fatalities in motor vehicle crashes from the year before. "...the third year of decreases", stated S.C. Department of Public Safety director Mark Keel. Also connecting with the drop in fatalities, a survey was taken in 2006, resulting that 72% of people buckled up. The same survey taken again in 2010, 85% of people reported buckling up.

Blog assignment #2

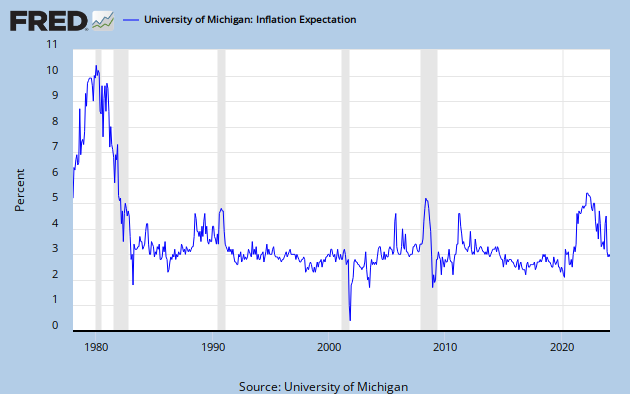

1. Many people would be interested in inflation expectation such as consumers, financial forecasters, the government, banks and firms in the marketplace.

2. There are two main ways to calculate inflation expectation. One way is to look at Inflation-indexed government bonds, you take the TIPS yield- the Treasury yield and it gives you the expected inflation rate. Another way is to survey people on what they expect inflation to be.

3.

Graph from http://research.stlouisfed.org/fred2/series/MICH

Data summarized from http://baselinescenario.com/2009/04/08/inflation-expectations-for-beginners/

Blog assignment #2

US Waterborne Freight

1) Anyone who ships cargo would be interested in this statistic. This could include not only people who ship cargo by water, but people who ship cargo by air or land, because they may be interested in changing their method of shipment. Government officials who are in charge of regulating waterborne freight or ensuring border security would also be interested in this statistic. Also, workers in any type of shipping industry, or those hoping for employment in a shipping industry, would be interested in US waterborne freight statistics.

2) This information is collected by the Army Corp of Engineers Navigation Data Center. Data on “waterborne commerce” appears to have been collected every five years starting in 1960 and then every year starting in 1990, but ending in 2008.

3) The most recent statistic for “US Waterborne Freight” in general (rather than for internal US waterways only) is from 2008, when the total amount of US Waterborne Freight was 2,469.8 million short tons. This level of freight is over double the amount in 1960 (1099.9 million short tons). Since 1960 there has been a general trend of a continuing increase in freight amount. This trend, however, is not steady (it does not make a perfectly increasing line), with increases or decreases of up to 200 million short tons from year to year.

Data summarized by the Research and Innovative Technology Administration (RITA) Bureau of Transportation Statistics, under Publications > National Transportation Statistics: http://www.bts.gov/publications/national_transportation_statistics/html/table_01_50.html

The Bureau of Transportation Statistics webpage linked to US Army Corp of Engineers Navigation Data Center where the data was originally published: http://www.ndc.iwr.usace.army.mil/wcsc/wcsc.htm

Blog #2

1. At the macroeconomic level, many areas of government would probably be interested in this statistic because it gives an idea of how much capacity is currently available to produce goods versus how much is actually being used. At the microeconomic level, firms may be interested in comparing their capacity utilization to the rest of the industry.

2. This statistic is collected and published by the Federal Reserve Board on a monthly basis.

3. Capacity Utilization for the United States in 2009 was 71.1%. The average from 1972 to 2009 is 80.6%. Since 1972, capacity utilization hasn't gone much higher than 85% , and the low was 68.2% in 2008.

http://www.federalreserve.gov/releases/G17/Current/default.htm

Monday, January 10, 2011

Blog assignment #2

http://www.census.gov/const/C30/totsa.pdf

1.Individuals that would be interested in this statistic could be construction companies, the US itself so that they can have an idea of how much they are spending on construction, construction workers because they will be able to get an idea of the number of job opportunities, businesses that are budgeting to establish new buildings.

2.The statistic of the US construction spending was collected by the U.S Census Bureau in November 2010. This information is collected every ten years.

3. The total US contruction for Nov. 2010 was $810,225 while $806,686 in Oct. 2010

The percent change from Nov. 2010 to Oct. 2010 was 0.4; from Nov. 2010 to Nov. 2009 was -0.6. Although their is an increase on the spending that the US is spending on construction overall in the past couple of months, the percent from Nov. 2009 to Nov. 2010 is negative which means that in the past year the US has decrease its spending on construction.

Blog Assignment #2

1. This information could be important to a variety of people. The most obvious would be people who work within the Federal Reserve, those within the Treasury and also policy makers as they make choices on the economy. As well, it might be helpful for companies to know how much money the American public has to spend on there goods and services.

2. Information on the M1 money supply is both collected weekly and monthly by the Federal Reserve. The money supply is also forecasted by different financial firms and agencies who are interested in the potential gains and losses.

3. In the final week of December, the M1 money supply was reported to have a weekly average of 1859.7 billion dollars (seasonally adjusted). This encompasses all currency outside of the Federal Reserve, the U.S. Treasury, and other depository institutions. As well, it includes any non-bank issued traveler’s checks, demand deposits, and other checkable deposits. This is a high point for the year, although not the peak. The money supply has been steadily increasing since the beginning of 2009 when it began at 1583.5 billion dollars.

Statistics and information from:

http://www.federalreserve.gov/releases/h6/current/

http://www.forecasts.org/m1.htm

Blog #2

Blog Assignment 2

Blog #2

1. I think many people would be interested in this information: Politicians, hospitals, community health clinics, and insurance companies to name a few.

2. The data was collected by the US govt using the current population survey (CPS). The data collected asks questions related to the previous year's coverage. The survey takes place between February to April as part of an income survey. The data reflects annual data collection from 1987.

3. The most recent numbers are from 2007, and show a decrease in the percentage of uninsured Americans from the previous year: 15.8(2006) to 15.3 (2007). It also shows the reported number of uninsured Americans to be decreasing over the same time period: 47M(2006) to 45.7M(2007). In a related stat, the survey showed that the number of people with health insurance actually increased from 2006 to 2007, and the number of people insured privately fell over the same time period.

Sunday, January 9, 2011

Blog Assignment #2

Producer Price Index (PPI) program measures the average change over time in the selling prices received by domestic producers for their output. The prices included in the PPI are from the first commercial transaction for many products and some services.

The primary use of the PPI is to deflate revenue streams to get the real picture of output

1. Domestic manufacturers, foreign manufacturers, investors, politician.

2. The data is collected monthly by the Bureau of Labor Statistics in a systematic sampling way. The sample includes producers in manufacturing, mining and services industries. Respondent participation has been conducted on a voluntary basis.

3. There are three important PPI classification system structures, which are industry, commodity and stage of processing. The PPI for finished goods (a selected commodity grouping by stage of processing) for November 2010 is 181.9 (unadjusted).

The unadjusted October 2010 index is 181.2, the percentage increase is 0.386%. The adjusted percentage increase from October 2010 is 0.8%.

The unadjusted July 2010 index is 179.5, the percentage increase is 1.337%.

The unadjusted percentage increase from November 2009 to November 2010 is 3.5%.

http://www.bls.gov/news.release/ppi.t02.htm

http://en.wikipedia.org/wiki/U.S._Producer_Price_Index

Wendy Tam

Assignment #2

http://www.census.gov/const/www/newresconstindex.html

1. Housing starts are seen as a broad economic indicator, and almost anyone would be interested in the statistics. More housing starts show strength in the economy, and vice versa. Some groups who are directly affected by housing starts include: construction workers, stock traders in the home-building sector, and financial institutions that grant loans for these projects. Additionally, local economies benefit from housing starts as workers and homeowners will spend money during the project.

2. Statistics are collected jointly by the US Census Bureau and the US Dept of Housing and Urban Development. Results are estimated from sample surveys and are published monthly.

3. Housing starts are measured units of "new privately-owned housing units authorized in permit-issuing places." The most recent statistics are from November 2010: 530,000 new units. This is down 4% (+/- 2.9%) from October 2010, and down 14.7% (+/- 1.7%) from November 2009.